Pricing models of customer engagement platforms: Explained

For mobile marketers, navigating complex pricing models of customer engagement platforms can be a challenge. Do you wish to determine the perfect pricing model for your app, while avoiding overpayment? In this article, we’ll guide you through the pros and cons of existing approaches.

Customer engagement platforms structure their pricing tiers based on required scenarios, considering the maturity of apps and the tasks they aim to address. One of the main criteria is based on the app’s growth stage, which can be measured through the count of either users or devices. Let’s get into the details.

Pricing models based on MAU

Many customer engagement platforms utilize MAU (Monthly Active Users) count as a charging method.

In the mobile market, MAU represents the number of unique users engaging with an app within a month. The definition of what constitutes engagement may vary, but it typically revolves around meaningful user actions such as opening the app, logging in, making a purchase, performing a session, or viewing a page.

However, when it comes to customer engagement platforms, they often apply their own interpretations of MAU, which might differ from the standard market definition or include additional parameters. This leads to hidden factors and complexities that businesses need to be aware of. Let’s delve into these interpretations to better understand their implications on pricing.

1. Pricing model based on MAU + data points (actually, on data points)

Used by: Braze, CleverTap.

Within this approach, pricing tiers are based on the MAU count and include a pre-defined limit of ‘data points’ for each MAU.

Data points relate to the information logged on user profiles and include various user actions within the app: page views, clicks on a link, and purchases — as well as changes in user profiles or transitions to another segment.

The fact that there is a limit on the number of data points for each MAU is often not explicitly indicated, so it’s always a good idea to explore the provider’s documentation and seek transparency in billing.

Cost-effective for: apps that primarily use customer engagement platforms for analytical purposes rather than engagement campaigns.

By contrast, apps with high user engagement and frequent marketing experiments (A/B/n testing, tags/segments experiments) may find it challenging to accurately project data point usage.

Example: Let’s say, in your selected plan, you have 700 data points allocated for one MAU. These data points could be distributed as follows:

- 100 user attributes that change each month;

- 50 events, with 10 attributes for each event, totaling 500 data points.

At present, this allocation might be sufficient for your needs. But what if after a month you decide to start collecting new events and you no longer fit within the limits? All in all, with this approach, you are constrained in terms of the amount of data you can take into operation.

| 🤔 Limitations of the pricing model based on MAU + data points | ||

|---|---|---|

| Low predictability for data points usage and final cost: Predicting when the data point limit will no longer be sufficient for your needs is challenging – it could happen unexpectedly and abruptly. To meet this challenge, you have to forecast all changes in custom events and user attributes for the long term. |

2. Pricing model based on MTU (Monthly Tracked Users)

Used by: MoEngage, Mixpanel, Amplitude, mParticle.

The pricing model based on MTUs is a way to calculate billing based on the number of users that perform one or more qualifying events within a calendar month.

Each platform defines a qualifying event according to its own criteria. Notably, the definition may include events that are not generated by users themselves, and therefore, they do not reflect the actual count of engaged users.

Cost-effective: when a platform’s definition of MTU aligns with the market’s understanding of MAU. In such cases, the model offers good predictability.

| 🤔 Limitations of the pricing model based on MTU | ||

|---|---|---|

| Lower ROI: As the MTU count may be not equal to the number of engaged users, the ROI of marketing campaigns might be lower. |

To overcome all the uncertainties surrounding pricing models based on the interpretation of MAU counting, an alternative option emerges: a pricing model based on device count.

Pricing model based on push subscribers

Used by: Pushwoosh, OneSignal.

This pricing model calculates the cost of a customer engagement platform based on the total number of push subscribers (devices with valid push tokens). Pricing plans based on the device count typically come with unlimited data points.

Cost-effective for:

- Apps that conduct numerous marketing experiments (running A/B/n tests, creating multiple tags and segments) and wish to avoid overpaying for excessive data points resulting from these activities.

- Apps whose primary engagement channel is push notifications and that want to ensure that they pay only for reachable users.

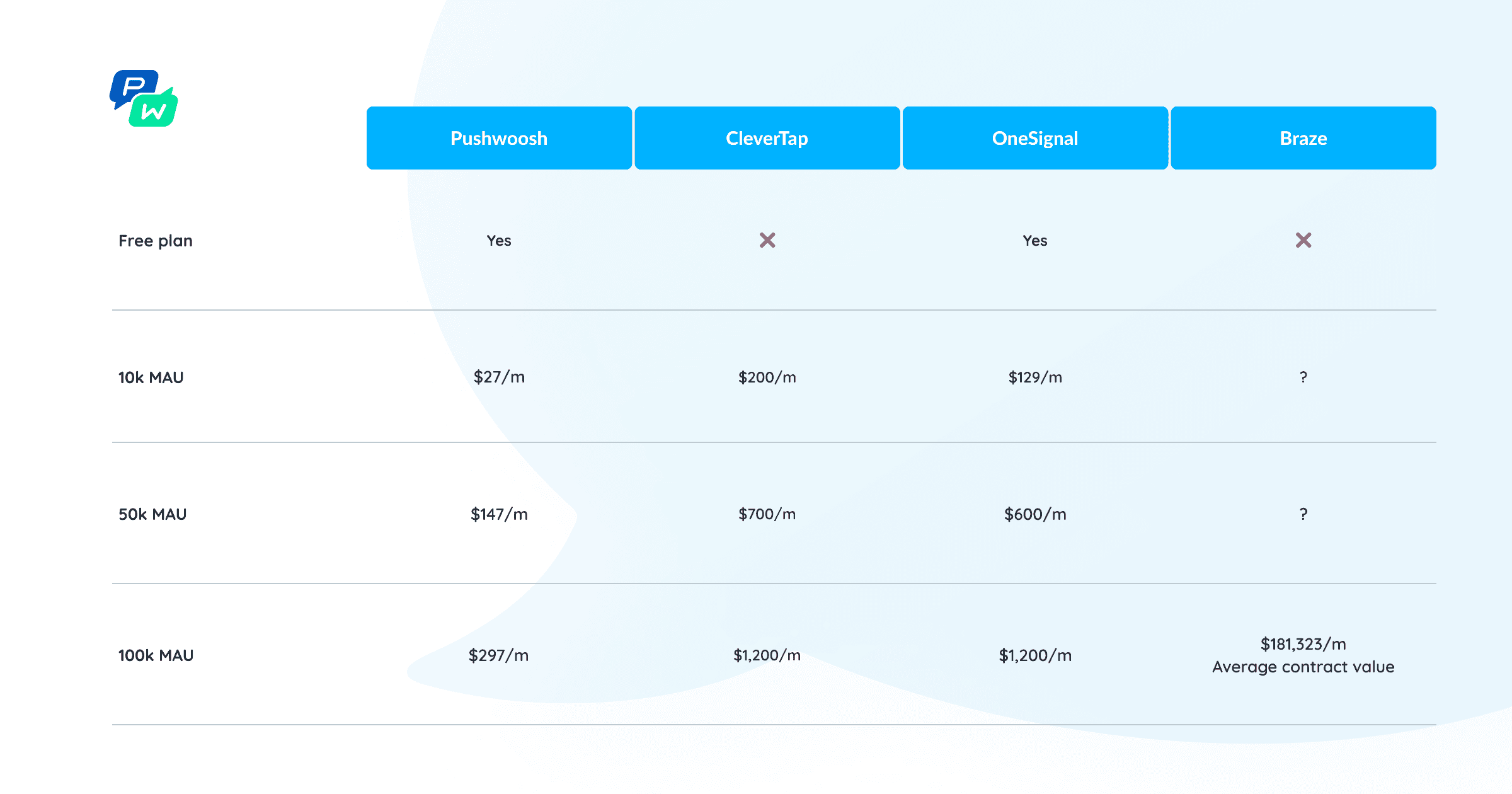

Example: Pushwoosh’s Base plan includes an allotment of 1,000 push subscribers for free with each additional 1,000 subscribers at an extra cost of $3 per month. The pricing model based on push subscribers ensures transparency and enables businesses to make well-informed decisions.

| ✅ Benefits | 🤔 Limitations |

|---|---|

| _ Predictable billing: Apps don’t have to forecast their data points usage; _ Higher ROI for push notification campaigns: Apps are billed solely for the number of users who can be reached via push notifications. * Access to the entire audience For the cost you pay, you acquire access to the entire audience and can lately re-engage users who haven’t interacted with the app, all without incurring any extra expenses. | * Navigation difficulties: As mobile marketers are accustomed to planning their engagement strategies based on MAUs, it may be challenging for them to navigate pricing tiers based on a different metric, such as the number of push subscribers. |

💡While both OneSignal and Pushwoosh share a subscriber-based approach, a **key distinction arises in their in-app messaging pricing strategy.** Unlike Pushwoosh’s fixed pricing, OneSignal charges for in-app impressions, potentially resulting in fluctuating costs. This distinction highlights the importance of budget predictability and engagement without limits.

Deciding on the perfect pricing model for your app

So, whether a pricing model works well for a particular app depends on the app’s engagement tactics, as well as the specifics of its marketing strategy and financial planning.

Apps that use customer engagement platforms more for analytics rather than for engagement campaigns, can adapt to the data-point-based model.

The MTU-based pricing model can offer predictable billing in case the MTU definition solely comprises events initiated by users.

Finally, for apps seeking cost-effectiveness while experimenting with marketing tactics and targeting users through push notifications, the pricing model based on push subscribers proves to be an optimal choice.

Ready to discuss your pricing in details? Get in touch with Pushwoosh Team:

Compare Pushwoosh’s plans and choose the right one for you: