Scaling emails with Pushwoosh: Growing from 1M to 8M emails MoM

Supported by Pushwoosh’s personalized and behavior-based emails, a South African fintech startup has grown its user base by 8x within a year. Due to an NDA, we cannot disclose the startup’s name.

The fintech industry is particularly data-sensitive. That is why we are sharing this case with caution and without disclosing sensitive information. Contact us if you want to explore more solutions for the fintech industry.

Unifying data to provide excellent communication

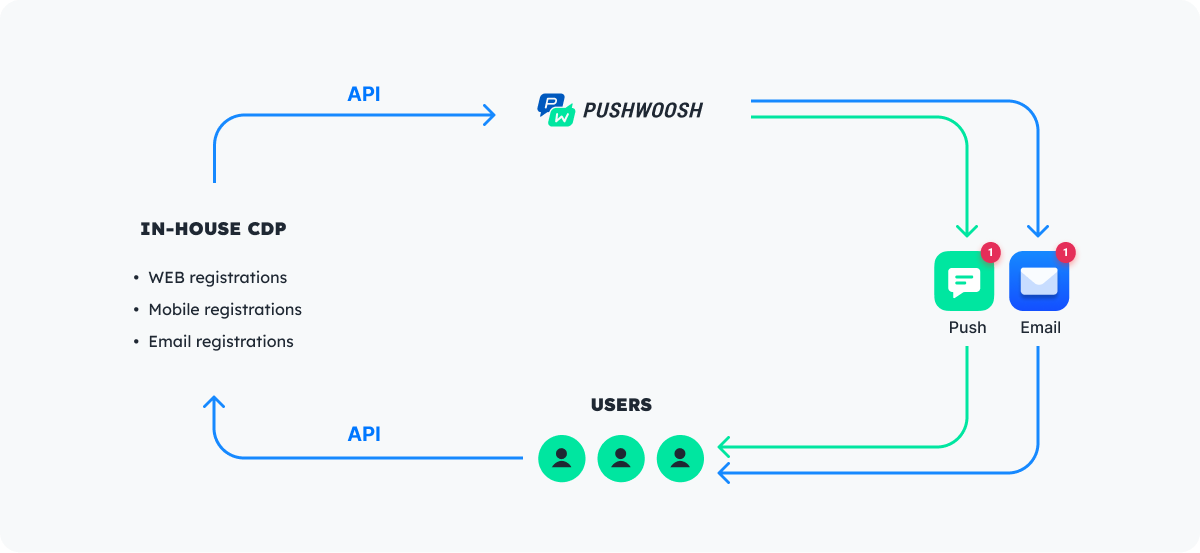

To ensure data protection for its users, the startup has used its in-house CDP for data storage and management. Users can register and log in through their browser or mobile app, or simply sign up for the newsletter. All of this data must be synced in one place, ready to be used across the channels.

The startup’s previous email provider didn’t allow for the sophisticated sync and email-base storage. The team turned to Pushwoosh, their mobile push notification provider at the time.

Engaging users through their lifecycle

Thanks to simple and well-documented APIs, the fintech team was able to quickly automate the user lifecycle through push notifications and emails.

User segments sent from the in-house CDP to Pushwoosh, combined with events (user behavior), enable the team to automate the most important part of the user lifecycle:

- Welcome campaign: Five emails about features and user opportunities are delivered to the user’s email once a day, starting from registration. The team uses Time Delay here.

- User activities: Behavior-based emails are triggered to confirm actions and purchases users make in the app or website. The team uses custom events that trigger the campaigns here.

- Newsletters: Making newsletters country- and language-specific allows the team to get a higher response rate and analyze user behavior with a country breakdown. The team uses Segment Split here.

Syncing campaign results back to the in-house CDP in real time enables the startup to quickly analyze and report on them.

This is how the data sync works in this case:

Scaling communications with stability in mind

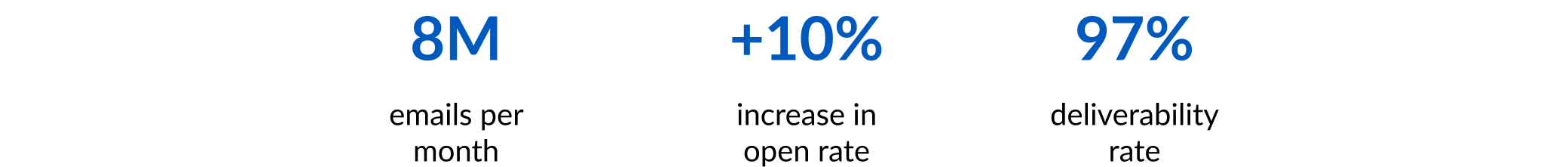

Within the first year of using Pushwoosh for omnichannel communication, the startup has increased its user base and the number of emails from 1M to 8M month over month. Handling such a high email volume requires impeccable infrastructure. Pushwoosh meets this challenge with ease, maintaining 99% uptime and a 97% deliverability rate.

PRO tips from the startup:

- Build a community. Companies can quickly establish their communities using tools like Slack and WhatsApp.

- Ask the community to whitelist your emails. This helps with spam avoidance, domain rating, and email open rate.

- Create excitement by announcing sneak peeks in the community and making them wait for your emails. This approach gave the team a +10% increase in open rates.

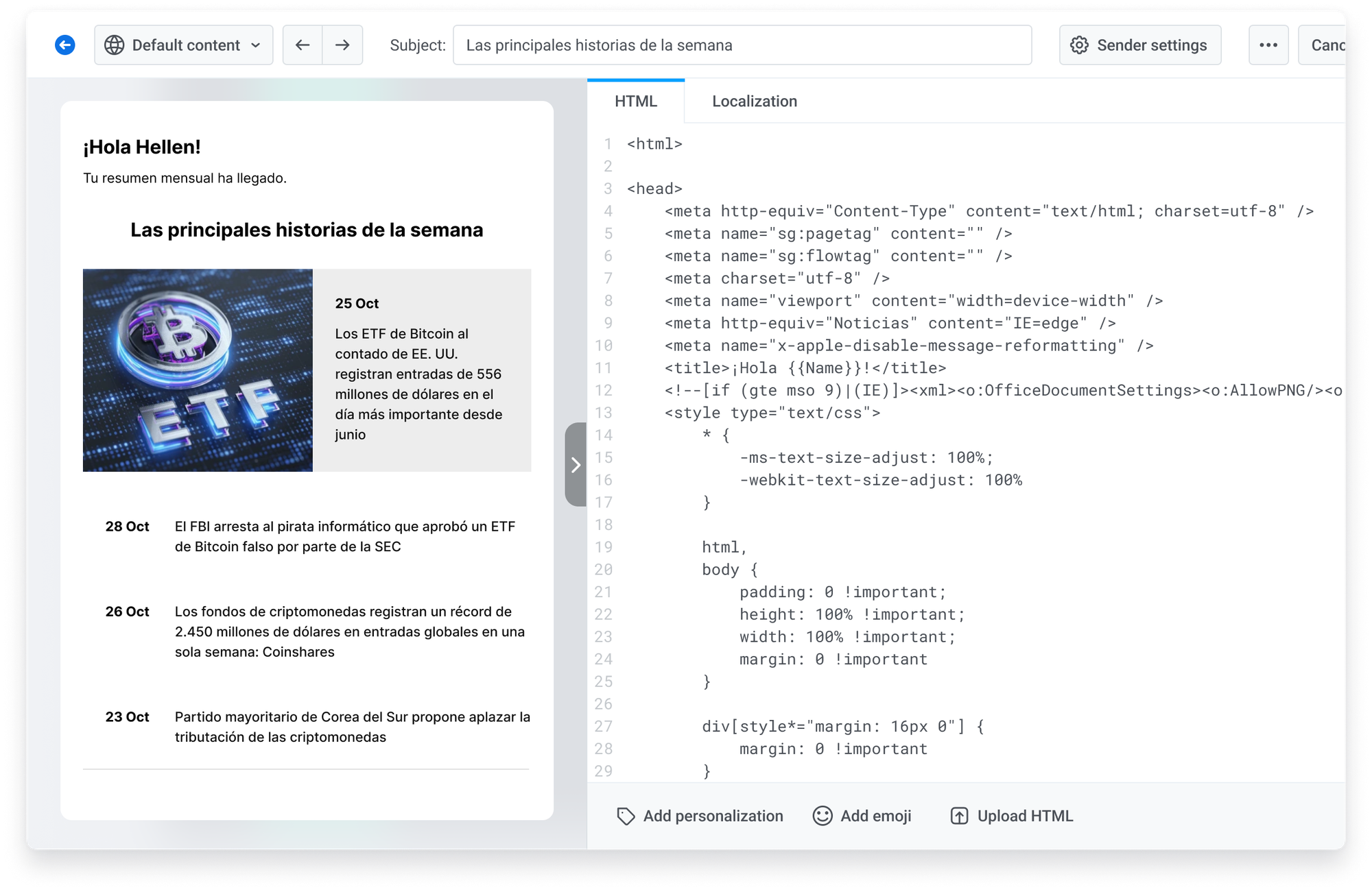

- Design beautiful emails that grab attention. HTML emails allow for language and color customization (e.g., more green colors for 🇧🇷 Brazil and red for 🇨🇳 China). HTML emails can be highly personalized using Liquid personalization, and they are simple to upload and use in Pushwoosh.

Talk to the Pushwoosh team to discover more tailored solutions for fintech.

![13 Best Practices to Increase Your Push Notification Opt-In Rate [with Benchmarks 2025]](/blog/content/images/2025/03/Push-Opt-in-Rate.png)